C-PACE Overview for Mortgage Lenders

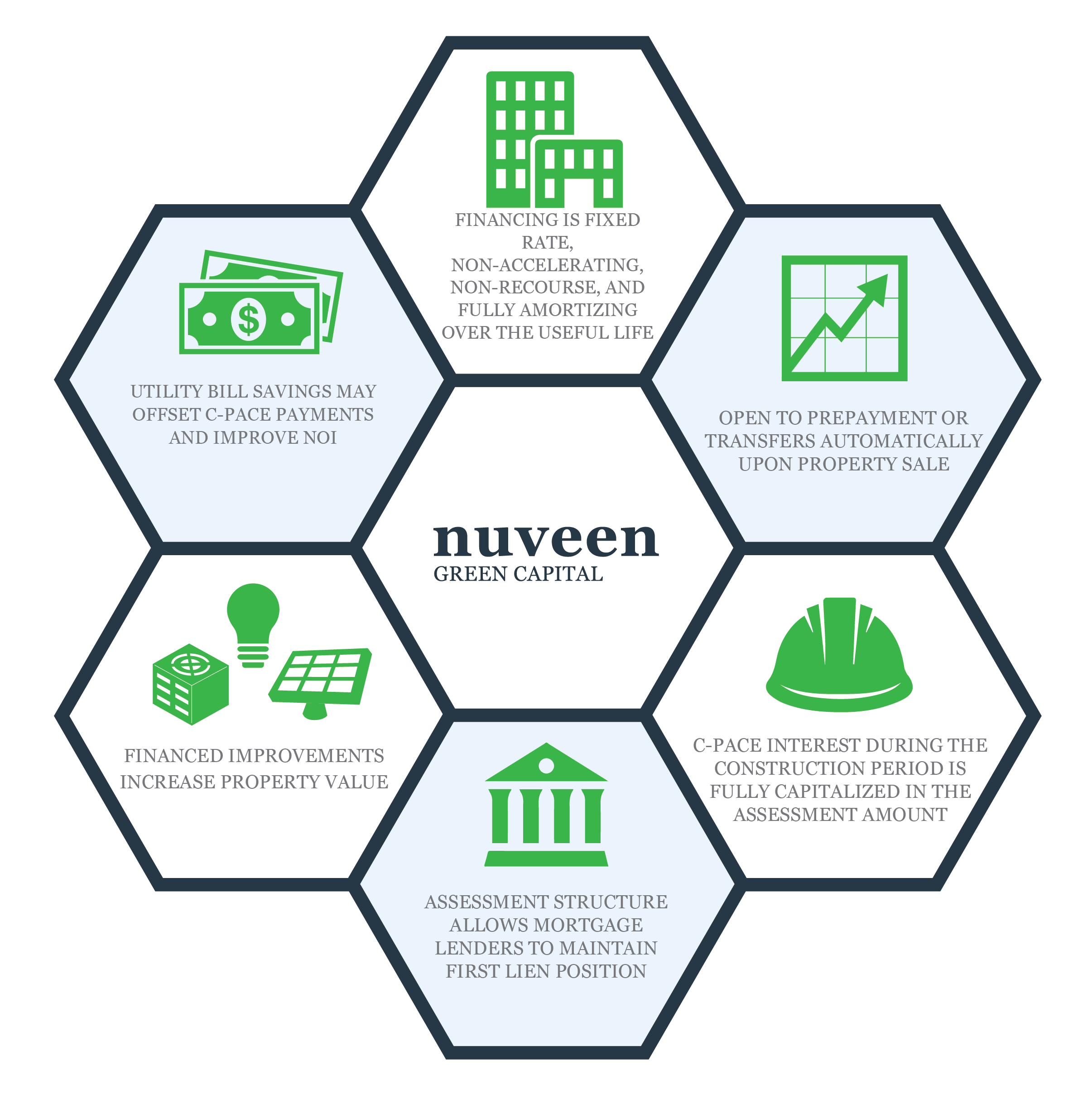

Commercial Property Assessed Clean Energy (C-PACE) makes it possible for commercial property owners and developers to obtain low-cost, long-term financing for energy efficiency, water conservation and renewable energy projects. The program starts with state-level legislation that classifies clean energy upgrades as a public benefit – like a new sewer, water line or road. These upgrades can be financed and repaid as a benefit assessment on the property tax bill over a term that matches the useful life of improvements and/or new construction infrastructure (typically ~20-30 years). C-PACE is non-accelerating: only the current or past-due payments can be enforced through a tax lien. The full principal balance can never be called due unlike a traditional mortgage. C-PACE’s low, fixed rates (~6%) and dedicated financing prevent value-engineering cuts to green measures and improve long-term property value.

LENDER CONSENT

C-PACE Financing Requires Lender Consent From Any Lienholder on a Property

Commercial Property Assessed Clean Energy (C-PACE) financing is one of the fastest-growing capital sources for new construction and rehabilitation developments in the country. To date, over 200 senior lenders have consented to C-PACE. As property owners and developers increasingly seek out alternative capital sources to finance construction projects, it’s important that mortgage lenders understand and support new and developing trends in the real estate market.

ELIGIBILITY

All energy and water-related construction (ex. window, HVAC replacement, etc.) and associated soft costs or green new construction qualify

All projects must be approved by local C-PACE administrator to verify it meets the requirements of local C-PACE program

Project scope, engineering and savings reviewed by 3rd party engineer

C-PACE Improves Borrower Returns

Improves IRR and property net cash flow

Offers long term, non-recourse financing that can be passed through to tenants where applicable

Open to repayment at any time by borrower or transferred with title

Half the cost of preferred equity or mezzanine debt

Underwriting Considerations

Risks are bounded and can be mitigated through underwriting and legal protections

Assessments don’t impede senior lender foreclosure rights or process

C-PACE assessments cannot be accelerated

Funds are fully available at date of closing

C-PACE financing may improve debt service coverage

C-PACE may improve the value of senior lender's collateral

Senior lender may escrow C-PACE assessment

Why Use Nuveen Green Capital?

Nuveen Green Capital is the leading provider of C-PACE financing in the country. Our founders launched and lead the first successful C-PACE program and have brought their expertise and know-how to Nuveen Green Capital. We offer a transparent, rapid approval process and a dedicated team ready to assists with all aspects of a C-PACE financed project who can handle all the heavy lifting.