STABLE FINANCING THROUGH ANY ECONOMIC CLIMATE

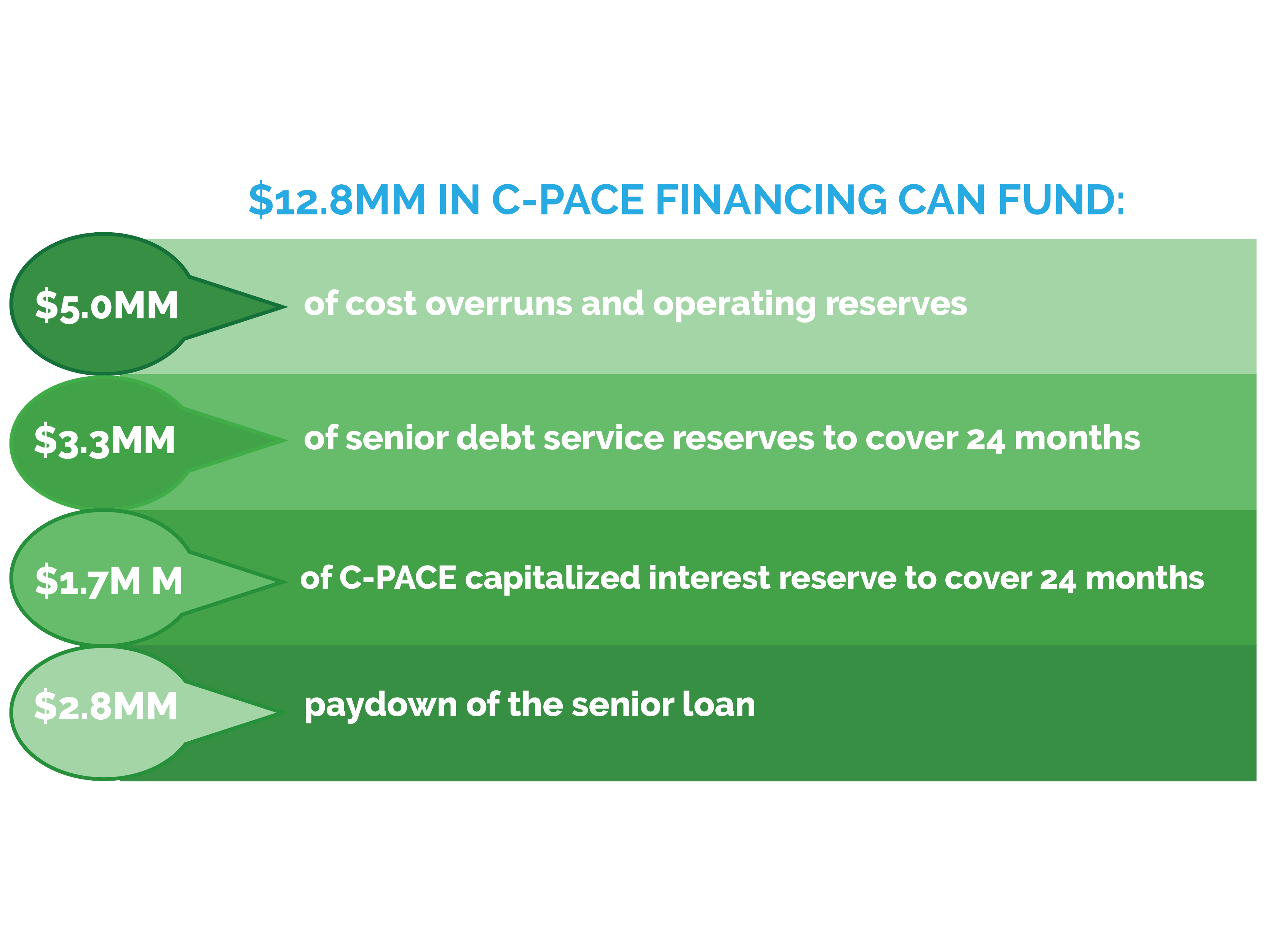

PROCEEDS MAY BE USED TO:

Fund Construction Cost Overruns

Replenish Operating Reserves

Cover Existing Lender Debt Service

Pay Down Existing Leverage

PROGRAM HIGHLIGHTS:

Net proceeds up to 20% of property value

Fixed interest rate ~6% with a long amortization (20-30 years from first payment date)

Delayed first repayment – typically 24 months post-closing

Non-recourse except for ongoing development projects which require a completion guarantee

Financing secured via a non-accelerating property tax assessment (C-PACE assessment)

Prepayable at any time subject to declining payoff fee

No financial covenants after completion

Transparent, rapid approval process

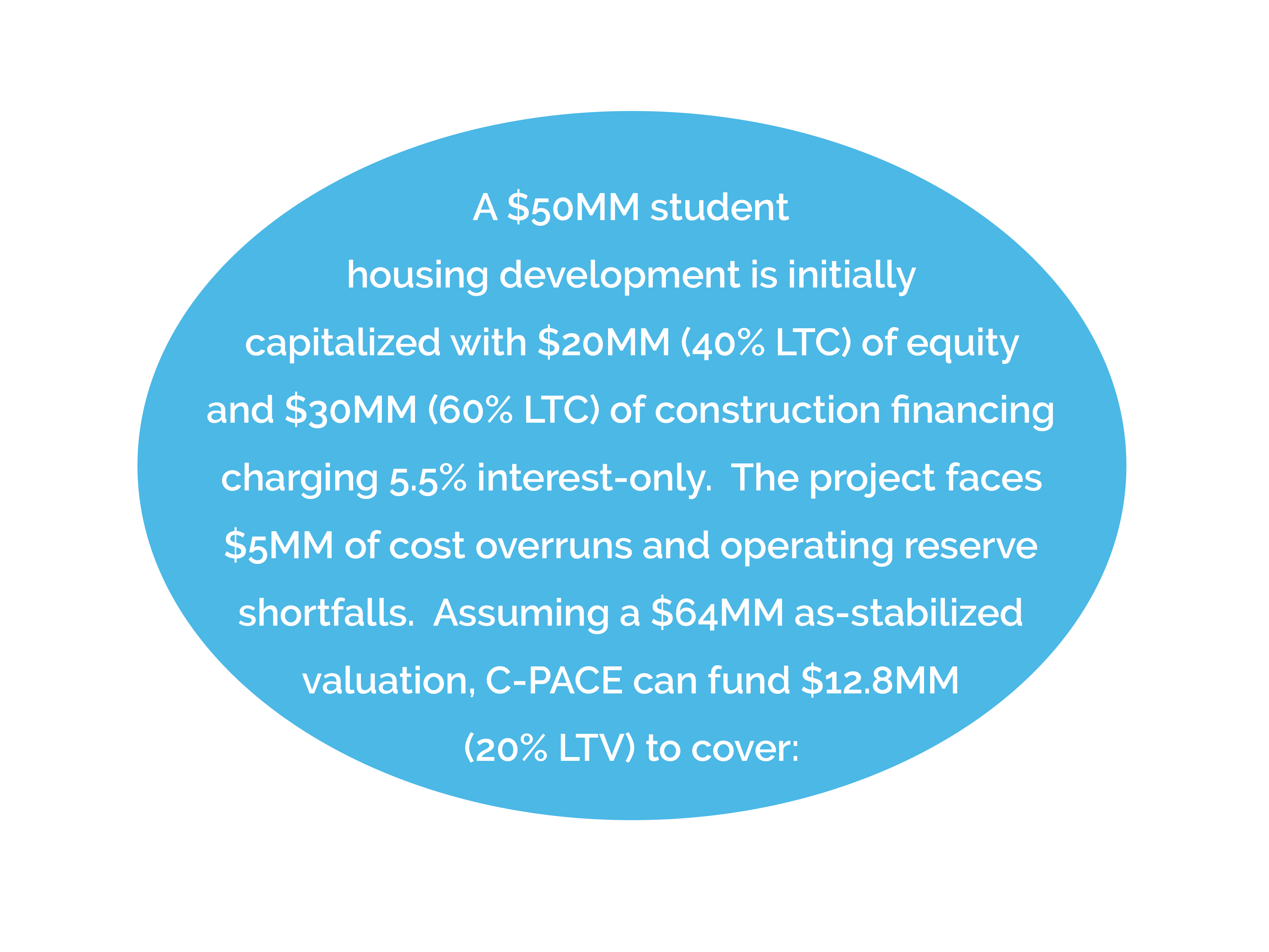

SAMPLE IMPACT:

Recapitalization for a $50M Student Housing Project

ELIGIBLE PROPERTIES AND SPONSORS:

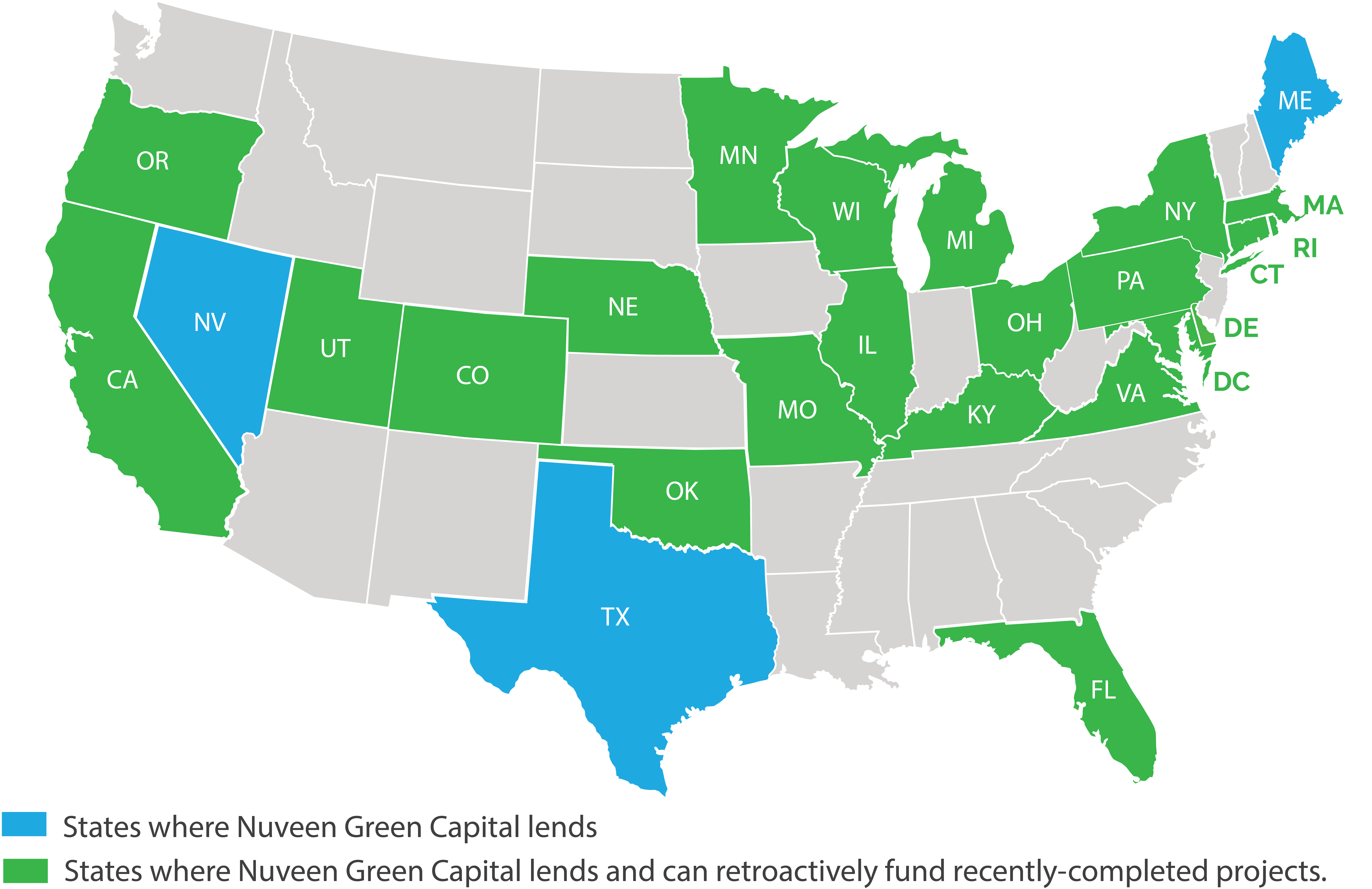

- C-PACE-eligible work planned or completed at the property within market’s relevant lookback period; ground-up development projects eligible in most C-PACE markets (see map below)

- All standard commercial property types qualify: multifamily, office, industrial, retail, hospitality, senior living, etc.

- Limited to well-located properties in a top 50 MSA

- No tax delinquencies in the prior 3 years

- Sponsor background searches will be run and any past material legal issues must be disclosed by sponsor up front

- Property must have a viable path to stabilization with a >1.25x DSCR within 5 years

- Properties with monetary defaults on existing financing will be reviewed on a case-by-case basis

- Written consent must be provided from all secured lenders

Retroactive Limits:

CA: 3 years |

MO: Case-by-case |

CT: 1 year |

NE: Case-by-case |

| CO: 2 years |

NY: Case-by-case |

DC: Case-by-case |

OH: No limit |

| DE: Back to 2018 |

OK: 2 years |

FL: 3 years |

OR: 1 year |

IL: 3 years |

PA: 2 years |

KY: No limit |

RI: Back to July of 2015 |

MA: 2 years |

UT: 3 years |

MD: Case-by-case

|

VA: 2 years |

MI: 3 years

|

WI: 30 months |

MN: 1 year |

|

C-PACE ELIGIBILITY:

Nuveen Green Capital’s recapitalization funds are limited by C-PACE (Commercial Property Assessed Clean Energy) eligibility

- Properties must have ongoing or recently completed C-PACE-eligible construction. Typically, all energy and water-related construction (ex. window, HVAC replacement, etc.) and associated soft costs or green new construction qualify.

- If C-PACE eligible construction is already completed, it must be located within a C-PACE program that allows for retroactive financing.

Why Use Nuveen Green Capital?

Nuveen Green Capital is the leading provider of C-PACE financing in the country. Our founders launched and lead the first successful C-PACE program and have brought their expertise and know-how to Nuveen Green Capital. We offer a transparent, rapid approval process and a dedicated team ready to assists with all aspects of a C-PACE financed project who can handle all the heavy lifting.

RECAPITALIZATION CASE STUDIES